Step 1: Free initial consultation with Sarah

Almost all of the work I do is on a flat-fee basis, so after a free initial consultation, you will know what to expect when it comes to billing. The price range for wills and trusts can vary greatly from one situation to another, based on the amount of assets and number of beneficiaries, as well as complex family or business details. Regardless of your circumstances, I am committed to providing you with a full range of options at reasonable rates.

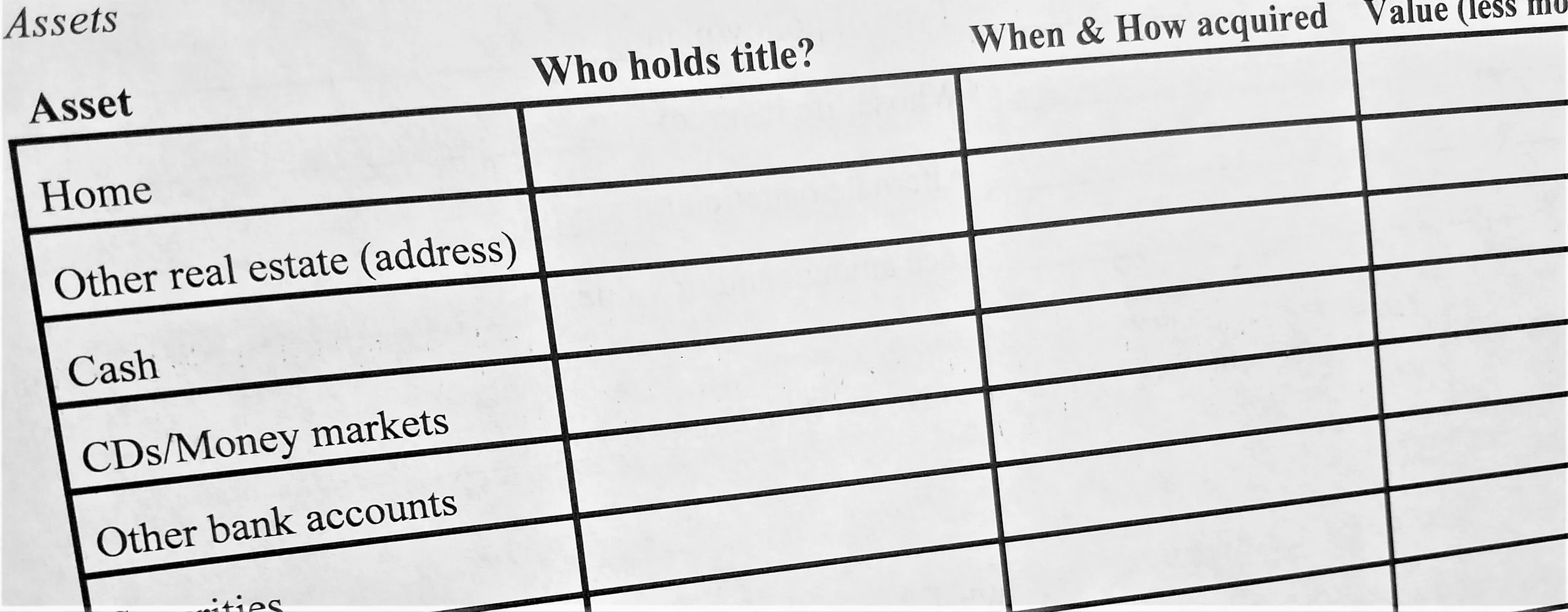

Step 2: Identify your

assets and beneficiaries

To properly determine the appropriate estate planning tools we will need to use, it is essential to look at the big picture of everything you have and everyone who could potentially receive it. This somewhat daunting task goes quickly with the help of checklists for personal and financial information (but don't worry, we won't forget your digital property or animals if those are of importance to you!).

Step 3: Prioritize

your needs and goals

You would think that if you know what you have and you know to whom it is going, this would be a simple task. It might be, but we will take the time to carefully assess the various options available to you. There is often give and take, for instance, between prioritizing the best tax situation and having money easily accessible. I will help shape your plan as you decide which of your needs are the most important.

Whether you need a simple will or detailed directives, be prepared to have your estate planning lawyer show you the whole picture.

Not many people use the phrase "estate planning." Perhaps they don't feel like their money and property are significant enough to justify using the word "estate." Instead, people talk about needing to have a simple will drawn up. While having a will is the starting point, "planning" is where the emphasis needs to be in estate planning. It is for everyone — and it is significant — regardless of the monetary value of your assets.

For young families, one important topic that comes up is whether the same person should care for both your children and your finances. You can make a plan that addresses guardianship for your minor children, and then decide how to pass along your assets to your beneficiaries,. Create the flexibility to provide adequately for their living expenses through their teen years, to manage the money you may have set aside for their education, and designate a person to help them take over their own finances eventually.

Older folks, on the other hand, may be more concerned about tax implications of gifting before they reach their later years or preparing health care directives long before they become a necessity. The tax code changed significantly in 2017, and existing estate plans should be re-examined in light of those changes. Health-related documents such as a power of attorney specifically for health care, organ donation forms, and living wills should also be developed as desired.

Whether young, aging, or anywhere in between, there is never a bad time to make good preparations for your future.